Enterprise procurement was never designed for the world it now serves. What began as a back-office function for moving invoices has become an accidental frontline defender against vendor breaches, compliance failures, and billion-dollar operational risks. Yet the workflows behind this critical function have barely changed in two decades.

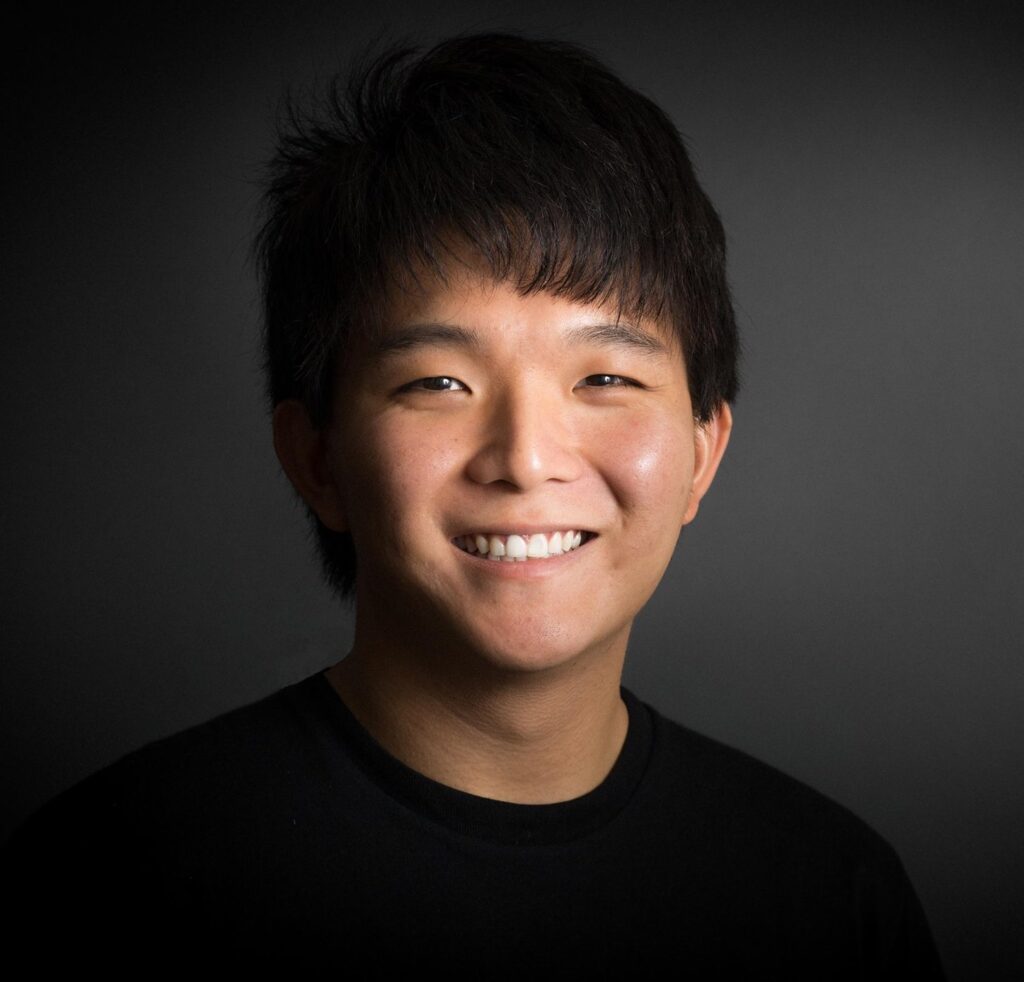

For Clarence Chio, co-founder and CEO of Coverbase, the turning point came years before he wrote a single line of code. At his previous startup, Unit21, an anti–money laundering compliance company serving heavily regulated financial institutions, Chio found himself trapped in procurement and vendor-risk cycles that stretched for months, even more than a year.

“We were a critical vendor, yet onboarding us required full-time resources just to respond to diligence requests,” he recalls. “And the worst part was realizing that none of it was actually effective. People were going through motions that weren’t uncovering real risk.”

That frustration became the foundation for Coverbase, an AI-native platform designed to overhaul procurement and third-party risk management for companies where the stakes couldn’t be higher.

The New Procurement Stack Is Agentic

Chio describes Coverbase as an “AI-agent-first” system. Most of Coverbase’s customers are highly regulated enterprises, banks, credit unions, fintechs, healthcare organizations, airlines. They already live inside legacy procurement systems like Coupa or Ariba, platforms not known for modern APIs or automation-friendly interfaces. Instead of trying to replace these systems, Coverbase built agents that work around them.

“Our agents operate like a team of contractors the company hired,” Chio says. “We read information, pull it from stakeholders, analyze it, compare it to internal controls and regulations, and push outcomes back into legacy systems. This bypasses constraints that traditional software can’t.”

The Hidden Complexity Nobody Sees

From the outside, procurement looks like a paperwork problem. Chio learned quickly that it is anything but.

“Every procurement workflow has three parties involved: the procurement team, the internal stakeholder, and the vendor,” he explains. “None of them, except procurement, sees facilitating this process as their job.”

This creates a deceptively complex information bottleneck.

For example, Coverbase discovered it takes an average of 12.5 emails to get a single vendor to submit required onboarding information.

This means companies are paying risk analysts $150k–$200k salaries to chase vendors manually, one email at a time.

Coverbase’s agents now handle that entire flow autonomously.

“We reach out continuously, collect information, check completeness, ensure accuracy, then carry it into policy analysis,” he says. “It turns out the most valuable thing we automated was simply getting vendors to respond.”

Security Risk Isn’t All About Accuracy, It’s About Systems

Many companies approach AI with unrealistic expectations, either overly optimistic or overly skeptical. Chio argues that both views miss the point.

“People over-index on accuracy,” he says. “But what even is accuracy in these processes? Every statistical model will make mistakes. Every human reviewer will too.”

Instead, he pushes customers to rethink AI the way they think about onboarding new hires.

“You hire people expecting they’ll make mistakes, and you build processes around that reality. AI should be evaluated the same way, on false positives, true positives, and usefulness, not perfection.”

Procurement’s Identity Crisis

Chio believes procurement has spent years living with a branding problem. “They’re usually seen as blockers,” he says. “They’re not first in line for shiny new tools. They deal with immense pressure but almost no recognition.”

Coverbase’s long-term mission is to rewrite that identity.

“We want companies to see procurement as a function that keeps them safe,” he says. “A business partner that enables innovation rather than slowing it down.”

And the only way to achieve that shift is to move procurement upstream by shifting-left from risk review into sourcing, contracting, and even vendor selection.

With a new $16.5M Series A funding round, Coverbase is expanding precisely in that direction.

“We started with due diligence and compliance reviews,” Chio says. “Now we’re expanding into sourcing, contracting, and invoicing because customers want the entire workflow connected. Everything becomes easier when procurement gets involved earlier.”

A Category on the Edge of Reinvention

Procurement is rarely described as exciting. Chio acknowledges this with a smile.

“These are overlooked problems,” he says. “But they’re incredibly valuable to solve. Procurement teams are hungry for someone to care about their workflows. They want help. They want modern tools. Nobody has been building for them.”

Coverbase is betting that the next decade of enterprise risk automation will start here, not in consumer-facing AI, but in the quiet operational chokepoints that decide whether a vendor brings innovation or catastrophe.

And by embedding AI agents directly into the messy, complex, risk-laden world of procurement, Clarence Chio believes he can shift the function from back-office friction to a strategic driver of safety, speed, and innovation.

“We’re still early,” he says. “But this is the moment to change what procurement means. Not a blocker. Not a cost center. But a truly strategic partner to the business.” For an industry long accustomed to slow cycles and opaque risks, that shift could change everything.