Navigating the rental market as a landlord or tenant in Canada is incredibly challenging. If you’re a landlord, how do you find a high-quality tenant? We have heard countless horror stories of landlords and tenants battling in Canada. One company is aiming to change this space. Toronto-based SingleKey is on a mission to remove the common headaches of renting. The platform simplifies the residential leasing process and provides landlords with peace of mind by managing their risk. In 2022, it acquired a Y Combinator-backed startup called Naborly. Founded in 2019 by Viler Lika, the platform has been growing significantly year over year. Here’s our interview with Viler about SingleKey, how they’re reducing risks for landlords and tenants, and what’s next for the company:

What was the inspiration for SingleKey?

SingleKey was initially founded to reduce risks for small landlords. During my time at the bank, I recognized how critical rental income is in helping real estate investors pay for their mortgage and property expenses. If tenants don’t pay their rent, these investors, particularly landlords with only one or two properties, run into a major cash flow problem and risk losing their property.

SingleKey’s Rent Guarantee was created to address this challenge. By covering losses that come from rent payment defaults, legal fees for evictions, and property damage, the Rent Guarantee Program minimizes the financial risks of renting for landlords by spreading their risk across our large portfolio of thousands of leases that we guarantee.

To qualify tenants for the program, SingleKey also designed a tenant screening service. We’re now proud to say that our Tenant Screening Report is Canada’s leading tenant screening tool.

How does SingleKey help landlords and tenants?

We give landlords access to essential information about their potential tenants, from their credit history to their past employment, so they can make an informed decision when leasing their property. They can also guarantee their rental income in case tenants don’t pay.

Tenants will also have free access to their credit report. This will allow them to share their credit profile as often as needed when applying for a new home without paying for multiple credit checks. This also enables tenants to reduce the negative impact to their credit by avoiding multiple credit inquiries.

Another way we’re helping tenants is through our Tenant Passport. With this new product, SingleKey will act as a guarantor on the lease to help them get approved.

We’ve seen your growth from acquiring a Y combinator startup to scaling up. Tell us more about the new partnership announcement with Nova Credit?

We’re extremely excited about the launch of our International Credit Check with Nova Credit because it’s a first-in-Canada product that tackles housing accessibility challenges for newcomers.

With the International Credit Check, we’re giving housing providers access to foreign credit history so that they can screen international tenants effectively. This means that landlords can feel comfortable approving rental applicants who are new to the country. At the same time, this partnership will help new Canadian families get approved for their new homes faster without having to pay 6 to 12 months of rent upfront.

The rental market in Canada is insane. What advice do you have for tenants navigating the rental market?

We’re seeing that the rental market is starting to stabilize and slow down in some areas in 2024. The challenge most tenants are facing is affordability, where in the more competitive markets like Vancouver or Toronto, rent-to-income ratios are pushing close to 40%, so tenants are paying close to 50% of their income on rent. To help with affordability, some common sense strategies include getting a roommate or renting out a parking spot if you don’t drive. In places like downtown Toronto, you can get up to $300/month for parking in some buildings.

Other tenants are having trouble getting approved because they don’t have good credit, or they are students or new to Canada and have not built a credit history yet. For those applicants, we recommend having SingleKey as their guarantor through our Tenant Passport, or using our International Credit Check, which can help tenants bring their credit from back home to Canada.

What about the landlords looking for high quality tenants?

For landlords, have a formal tenant screening process in place. Make sure you’re running a credit check through a trusted source and verify the rental applicant’s income, employment, and rental history. Take the extra time to contact all the provided references and cross reference as much information as possible between the tenant’s rental application and credit report. Being diligent during the tenant screening stage is critical to finding a great tenant.

There are a lot of scams out there when it comes to renting. What are some ways both landlords and renters can protect themselves?

Renters and landlords should always verify the information they receive during the entire renting process. For renters, that means researching who the landlord or property management company is behind the rental listing and reading the lease thoroughly (or get a lawyer to review it for you) before signing the agreement. If you’re being pressured to pay before even seeing the rental, that’s a huge red flag.

On the landlord side, look out for supporting rental application documents that are commonly doctored, like proofs of income. Note any inconsistencies with formatting, alignment, and fonts. If a potential tenant is submitting PDFs as part of their rental application, you can check the file properties to ensure the author, content creator, and creation and modification dates look legitimate.

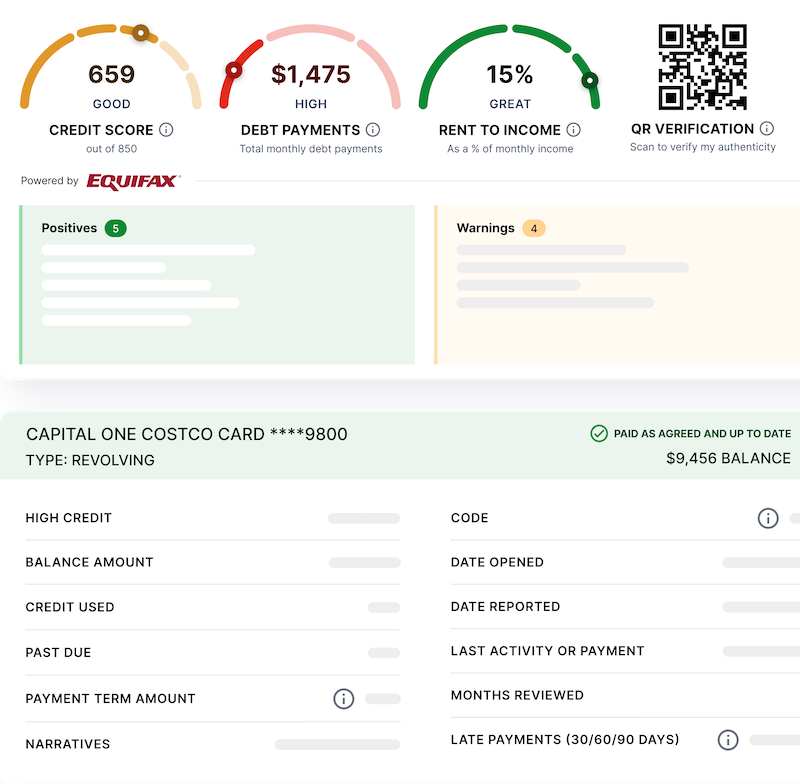

Since credit reports are also easily modified, we recommend getting a credit check through a third-party source like SingleKey, rather than the tenant themselves. Combating fraud is one of reasons why we’re now including a QR code on our Tenant Screening Reports, so that landlords can scan that QR code and verify that the data is correct from our website.

Where do you see your industry in the next five years?

We expect to see more policy reform on the development of purpose-built rentals, which will increase the supply of rental units from corporate owners. This will set a new standard in the rental market for quality and management. This will also have an impact on the enforcement of tenancy laws as an incentive to grow the supply of these types of rental units and to attract more investment in new rental units.

In 2026, affordable housing and rental supply will be significant topics of political debate for the upcoming election. Housing affordability has become a major pain point for the millennial and Gen Z generations, who are growing portions of the voting base and make up a higher percentage of renter households. This will be an accelerator in policy reform.

Lastly, because of the continued growth in immigration over the next five years, there will be even more demand in the rental market. This will increase the need for new rental supply in both large cities and secondary markets.

What’s next with SingleKey?

Given the magnitude of the challenges that renters and landlords are facing when it comes to housing affordability and lack of supply, I believe we are well positioned to make the leasing process more transparent and efficient while also helping landlords and tenants remove the risks that make it harder for some tenants to get approved. In doing so, we aim to streamline the leasing process and to incentivize more landlords to bring their units to market without the fear of non-payment of rent or potential property damages.

A decade ago, there was no such thing as online rental applications or tenant credit checks. As the risk has increased, where you can easily lose 12 months of rent if your tenant decides not to pay, landlords are becoming more risk-averse. This has made them more willing to conduct due diligence on their tenant and look for tools and services to help them reduce risk. At the same time, the new generation of landlords and tenants are more tech savvy and quick to adopt online tools to deal with these issues. So, as the leading tenant screening provider in Canada, SingleKey expects to grow to process over 500,000 rental applications per year and play a significant role in improving housing accessibility for tenants, while reducing risk for landlords in order to provide a more transparent, accountable, and fair leasing process for both parties.